Your cart is currently empty!

Accounting Equation Assets = Liabilities + Equity

The money in your bank account after you repay outstanding debt (i.e. student loans, mortgage, credit cards) belongs to you. If you take the total value of Assets and subtract the total value of Liabilities, then the remainder is value for Equity holders. cost centres define where costs are incurred Said differently, whatever value of the company’s Assets remains after covering its Liabilities belong to the owners. Whatever value is left after the company pays the money it owes to banks, suppliers, and employees belong to the company owners.

Balance Sheet Example

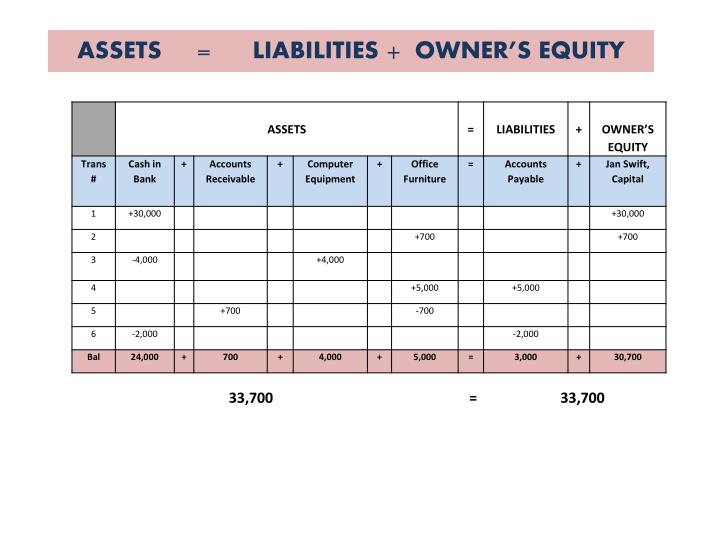

Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. In the case of a limited liability company, capital would be referred to as ‘Equity’. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand.

Accounting Equation (Explanation Part

The balance sheet is a very important financial statement for many reasons. It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health. The balance sheet formula states that the sum of liabilities and owner’s equity is equal to the company’s total assets. With an understanding of each of these terms, let’s take another look at the accounting equation.

What Is the Balance Sheet Formula?

- Please see Robinhood Financial’s Fee Schedule to learn more regarding brokerage transactions.

- Accounts within this segment are listed from top to bottom in order of their liquidity.

- Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

- Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E).

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. To learn more about the balance sheet, see our Balance Sheet Outline. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Real-World Example of the Accounting Equation

So it can tell you if the records are wrong, but it can’t certify if the records are accurate. For example, a $100 increase in an item under Assets must be met with either a $100 decrease in another Asset item or a $100 increase in Liabilities and Equity. If the accountants keeps accurate records, the Accounting Equation will always “balance”. It should always balance because every business transaction affects at least two of a company’s accounts. This is also a cornerstone concept that underpins the Balance Sheet.

The Purpose of the Balance Sheet

A company usually must provide a balance sheet to a lender in order to secure a business loan. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts. The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts.

A balance sheet must always balance; therefore, this equation should always be true. The formula defines the relationship between a business’s Assets, Liabilities and Equity. At any moment in time the Accounting Equation must balance. To learn more about the income statement, see Income Statement Outline.

Each entry is reflected in at least two places, like two sides of the same coin. They tell a different story about what happened to the same value. One cannot change without affecting the other, and neither can be stronger or weaker — just different. Drawings are amounts taken out of the business by the business owner. Suppose you buy a house for $200,000 with $120,000 in mortgage and $80,000 of your own money. The value of the house after deducting the liability belongs to you, which is $80,000.

It gives a more detailed account of how a firm manages its cash and CCE’s through its operating, financing, and investing activities. The critical thing to remember is that the stuff the business owns (assets) must be equal to the stuff the company owes (liabilities and equity). So, now you know how to use the accounting formula and what it does for your books. The accounting equation is important because it can give you a clear picture of your business’s financial situation. It is the standard for financial reporting, and it is the basis for double-entry accounting.

We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet. A balance sheet provides a summary of a business at a given point in time. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. Balance sheets serve two very different purposes depending on the audience reviewing them.

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years.

Share:

Sign up to our newsletter

Receive our latest updates about our products & promotions

Related Articles

Panduan Lengkap Pocketoption untuk Trader yang Cerdas

Selamat datang di dunia trading yang menarik dengan Pocketoption Pocketoption. Bagi banyak orang, trading menjadi sumber…

Погружение в мир трейдинга на Pocket Option Site

Часто сталкиваясь с вопросами о том, как начать зарабатывать на финансовых рынках, многие начинающие трейдеры ищут…

สล็อต888 เว็บแท้ API ที่ดีที่สุด 2024 สล็อตเว็บตรง ไม่ผ่านเอเย่นต์

ลูกค้าทุกท่านสามารถสมัครสมาชิกได้ง่าย ๆ ผ่านระบบอัตโนมัติเพียงแค่กรอกข้อมูลส่วนตัวเพียงไม่กี่ขั้นตอน ช่องทางการสมัครสามารถสมัครได้ผ่านทางหน้าเว็บไซต์หากมีข้อสงสัยติดต่อทางแอดมินได้ตลอด https://www.aids2012.org/ 24 ชม.

Subscribe

Subscribe

Để lại một bình luận